The Ultimate Service: Independent Adjuster Firms for Insurance Policy Claims Management

Wiki Article

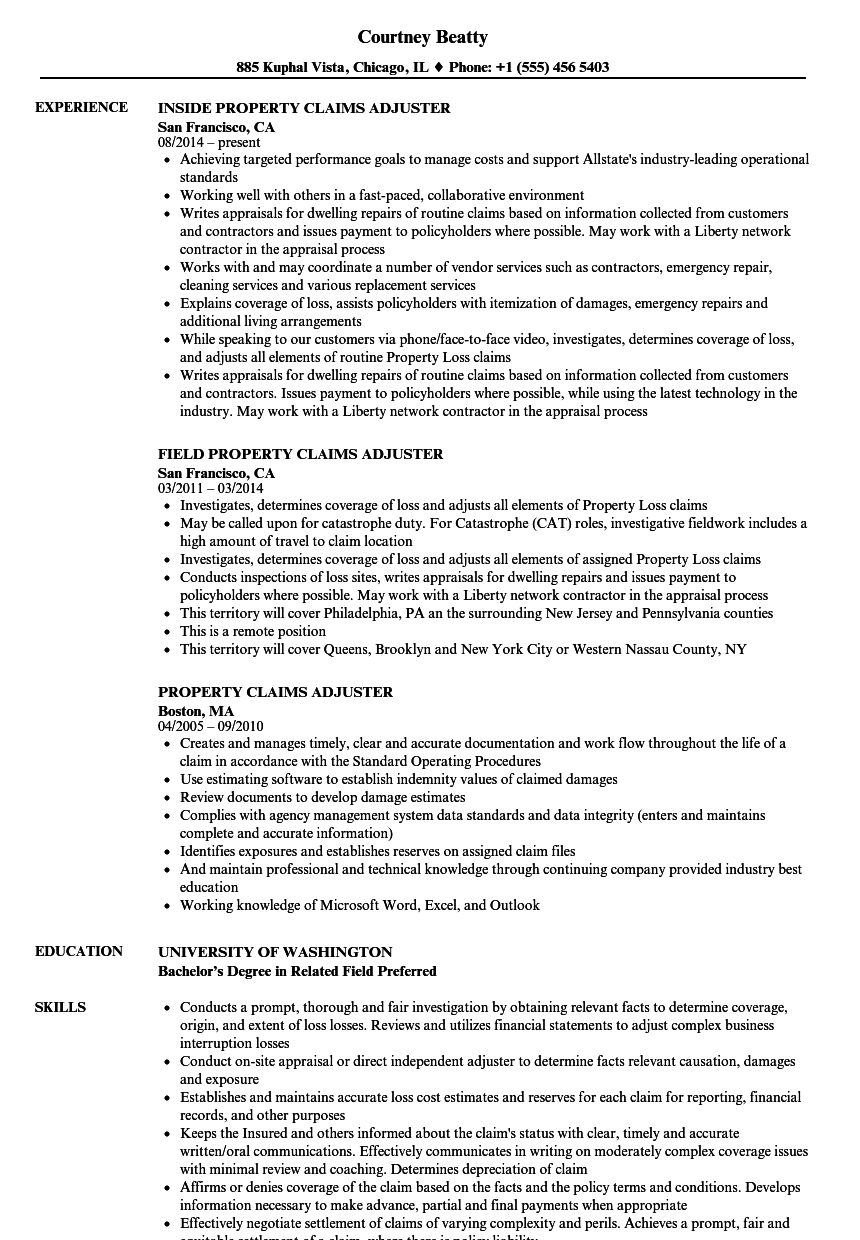

Unlocking the Secrets to Success as an Independent Insurance Adjuster in Insurance

In the elaborate world of insurance coverage cases, independent insurers play an important function in making certain reasonable and reliable negotiations for all parties involved. From grasping the art of client communication to developing settlement skills and embracing technological developments, the path to becoming a top-tier independent adjuster is paved with purposeful actions and continuous knowing.:max_bytes(150000):strip_icc()/insurance-claims-adjusters-1287095_final_HL-e332eccfdc1f4b8695cf01e7a81b436a.png)

Grasping Client Interaction

Grasping customer communication is a vital ability for independent insurers in the insurance sector to properly construct trust fund and take care of cases successfully. Succinct and clear communication is essential in making sure that clients comprehend the insurance claims process, feel sustained, and have confidence in the insurer's capabilities. By actively listening to customers' worries, offering regular updates, and explaining intricate insurance policy terms in an easy manner, insurers can develop a solid connection with clients.

Settlement Abilities Advancement

Developing reliable settlement skills is critical for independent insurance adjusters in the insurance market to efficiently fix cases and reach equally helpful arrangements with stakeholders. Settlement abilities surpass simply picking a dollar quantity; they incorporate the ability to pay attention actively, comprehend various point of views, and collaborate to discover services that satisfy all parties involved. Independent insurers must be skilled at examining the worth of a claim, supporting for fair settlements, and structure rapport with customers, insurance policy holders, and various other experts in the industry.To boost their negotiation abilities, independent adjusters can gain from recurring training, workshops, and mentorship programs that concentrate on problem resolution, interaction techniques, and calculated bargaining. Engaging and exercising circumstances in role-playing exercises can aid insurers improve their methods and become a lot more comfy navigating challenging discussions. Furthermore, remaining educated concerning sector trends, laws, and best methods can provide adjusters with important understandings to take advantage of during negotiations.

Leveraging Innovation for Efficiency

To improve their insurance claims processing and boost their productivity, independent insurance adjusters can harness the power of technological devices and platforms for enhanced performance in their everyday procedures. By incorporating technology right into their workflow, adjusters can expedite the claims handling process, decrease manual mistakes, and provide even more precise evaluations.One key technological tool that independent insurers can utilize is insurance claims management software program. This software permits insurers to arrange and track claims, interact with stakeholders, and produce reports extra successfully - see this independent adjuster firms. Additionally, making use of mobile applications can allow insurance adjusters to capture real-time information, access information on-the-go, and enhance communication with clients and associates

Additionally, artificial intelligence (AI) and maker learning technologies can help adjusters in examining information, identifying patterns, and making data-driven choices. These technologies can improve the insurance claims examination process, enhance precision in estimating problems, and ultimately bring about quicker case resolutions.

Structure Strong Industry Relationships

Establishing solid links within the insurance coverage market is critical for independent adjusters seeking long-lasting success and growth in their occupation. Structure solid market connections can open doors to new opportunities, improve your credibility, and offer useful sources to succeed in the area (independent adjuster firms). One key facet of promoting these connections is keeping clear and open communication with insurer, fellow insurance adjusters, contractors, and other industry expertsNetworking events, seminars, and on-line systems can work as useful devices to get in touch with people in the insurance coverage industry. Participating in these celebrations not only permits for the exchange of ideas and best techniques but likewise helps in developing depend on and integrity within the community. Furthermore, proactively joining market associations and groups can even more solidify your visibility and credibility as a reliable independent insurance adjuster.

Continuous Specialist Growth

Embracing a commitment to recurring knowing and skill improvement is essential for independent adjusters intending to flourish Going Here in the vibrant landscape of the insurance coverage sector. Continual specialist growth guarantees that insurance adjusters stay abreast of industry trends, regulations, and finest methods, pop over to this site which are important for providing premium services to customers.To attain success in this area, independent insurance adjusters should participate in different types of constant knowing. This can consist of participating in market conferences, registering in pertinent training programs, getting accreditations, and actively seeking comments from peers and advisors. By continually improving their knowledge and skills, insurers can adapt to the evolving demands of insurer and policyholders, inevitably enhancing their reliability and bankability in the industry.

In addition, staying present with technical developments in the insurance field is critical. Independent adjusters should spend time in finding out exactly how to take advantage of new devices and software to improve their procedures, boost effectiveness, and provide more accurate assessments. Accepting constant expert development not only profits the insurers themselves but also contributes to the general development and success of the insurance market all at once.

Conclusion

Finally, success as an independent insurer in insurance needs grasping customer communication, developing arrangement abilities, leveraging technology for efficiency, building solid sector partnerships, and taking part in continual professional growth. By refining these key areas, adjusters can improve their performance, enhance their track record, and inevitably achieve long-term success in the insurance coverage market.

Developing strong links within the insurance policy industry is critical for independent insurance adjusters looking for lasting success and growth in their profession. Proactively participating in market organizations and teams can better solidify your visibility and online reputation as a reputable independent insurance adjuster.

Report this wiki page